What is Olymptrade?

-

Olymptrade is an online broker/trading platform launched around 2014. (binaryoptions.net)

-

It offers “fixed‑time contracts” (similar to binary options / short‑term trades) along with some forex / asset‑based trades. (binaryoptions.net)

-

The platform claims to allow trading with low minimum deposits: some reports say as low as $10 (or its equivalent), making it accessible for people who don’t want to invest large sums initially. (binaryoptions.net)

-

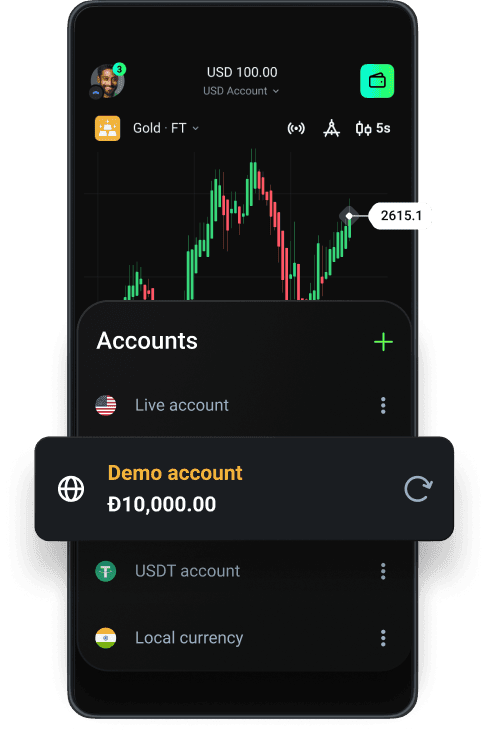

It also reportedly offers a free demo account (so that new users can practice without real money). (binaryoptions.net)

So in short — Olymptrade presents itself as a user‑friendly, entry‑level trading platform with relatively small minimum deposit requirements and easy access.

What Do Users & Reviews Say — Mixed Experiences

Opinions about Olymptrade are sharply divided. Below are common praises and complaints from real users, third‑party review sites, and public commentary.

✅ What some users like

-

On review platforms, some users call the interface “easy to navigate” and highlight that the trading tools and features are suitable for beginners. (Trustpilot)

-

Several traders say that withdrawals — at least sometimes — have been smooth and timely. Some mention receiving funds within expected timeframes. (Trustpilot)

-

For small‑time traders or beginners, who do not want to commit big capital, the low entry requirements and demo‑account feature seem useful to get started without major risk. (binaryoptions.net)

⚠️ Common Complaints & Concerns

-

A large number of negative reviews complain about issues with withdrawals or deposits — e.g. funds not credited, withdrawal requests delayed or rejected. (Trustpilot)

-

Some users allege that their account was blocked or closed once they tried to withdraw larger amounts. One comment says their account was “blocked … when it had around ₹15 lakh in it.” (Trustpilot)

-

Others say customer support is unhelpful or very slow: issues are unresolved, communication leads to repeats, or support gives generic responses. (Trustpilot)

-

On Sitejabber, there is a mention that many reviews seem “suspicious,” potentially fabricated or solicited. (SiteJabber)

-

More broadly, critics argue that fixed‑time contracts / binary‑option‑style trades (which Olymptrade offers) are risky: payout structures are often stacked against traders, and the chance of losing money is high. (Wikipedia)

In public forums too, you can find starkly contrasting views. Some users say they had “no issues” and got withdrawals fine. Others caution strongly — calling the platform “scam”, “fraudulent”, or warning that profits are difficult to withdraw. For example:

“This is a scam website. I deposited $13 … it’s been 10 days … They are scamming.” (Trustpilot)

“When I started making profit they blocked my account … despite repeated attempts, I received no support.” (Trustpilot)

Because of such contradictory experiences, user reviews give a very mixed picture.

Regulatory & Legal Risks — Especially for Indian Users

One of the most important aspects to know: using Olymptrade (and similar platforms) from India carries legal & regulatory risks.

-

According to Reserve Bank of India (RBI), online forex trading or electronic trading platforms (ETPs) must be authorised. Platforms not authorised under the Foreign Exchange Management Act, 1999 (FEMA) are considered unauthorised. (The Economic Times)

-

In that context, in a public alert list issued by RBI, Olymptrade appears among the names of “unauthorised forex trading platforms.” (The Economic Times)

-

Using unauthorised platforms may carry legal consequences under FEMA — in addition to risk of financial loss. (The Times of India)

-

From a financial‑protection perspective: while Olymptrade claims to be registered offshore (in Vanuatu under a license that many critics consider “low‑tier”), such offshore “regulations” do not give the same level of investor protection as a robust, government‑backed regulatory authority. (binaryoptions.net)

-

Moreover, binary options / fixed‑time trades (like those offered on Olymptrade) are widely considered high‑risk globally. Many regulators (in various countries) have either banned or strongly restricted binary‑options trading due to abuse, fraud, and high losses. (Wikipedia)

Thus — even if the technical platform works and some users get payout — there is a structural risk: you may not have legal protection, and there is regulatory danger if you are based in India.

What Kind of Person Might Benefit (or Lose) — Who It’s For & Who Should Avoid

Based on the pros, cons and risks discussed above, here’s a rough user‑type fit for Olymptrade:

Might be “okay (with high risk)” if you are:

-

A very small‑capital investor or “just experimenting” — someone who’s okay with using minimal money, treating this as a speculative exercise rather than serious investing.

-

Someone who fully understands the risk: knows that fixed‑time/fixed‑payout trades are more like gambling than conventional investing.

-

Prepared to use only amount you can afford to lose — and not rely on this for stable returns.

Should avoid if you are:

-

Looking for legal safety and regulated investing — since Olymptrade is not authorised by Indian regulators and may fall under banned categories for forex trading for Indian residents.

-

Hoping for steady investment returns or long-term investing — because fixed‑time binary-style trades are generally unpredictable and risky.

-

Not willing to accept the possibility of losing full capital or facing delays / issues in withdrawals.

My Verdict — Approach With Extreme Caution (or Better: Avoid)

In my view (especially from the perspective of someone in India), using Olymptrade is very risky and not recommended. Here’s why:

-

It lacks credible, strong regulation that ensures fund protection and fair treatment. Offshore “licenses” are weak compared to domestic regulation.

-

For Indian users, there is a regulatory alert from RBI regarding unauthorised ETP/forex platforms; using such platforms may have legal issues under FEMA.

-

The potential for financial loss is high — the platform’s structure (fixed‑time / binary‑option style) is more akin to gambling than long‑term investing. Audits, guarantee of fairness, or transparency seem weak.

-

Many user reports suggest poor experiences — blocked withdrawals, deposit issues, unresponsive support. While some users report success, it’s hard to verify the authenticity of many reviews.

If I were you — I would avoid using Olymptrade, or treat any money I put into it as “money I’m okay losing.” If you want investing/trading exposure, safer and regulated alternatives (mutual funds, stock markets via regulated brokers, SIPs, etc.) are better and more responsible.

Conclusion — What You Should Do

If you are reading this because you came across a link to “Olymptrade – Trading online”, here is what you should do:

-

Don’t trust flashy promises of “easy money” or “high returns in short time.” Treat those as red flags.

-

If you still want to explore — do so with zero expectation of profit, and invest only a very small amount you can afford to lose.

-

Consider exploring legal, regulated investment/trading options available in India (via registered brokers, SEBI‑approved instruments, mutual funds, etc.).

-

If you care about long‑term growth rather than quick gains, treat speculative platforms as nothing more than high-risk experiments — not serious investments.