What is Groww — Quick Intro

Groww is one of the most popular online investment platforms in India. People use it for buying and selling stocks, investing in mutual funds, trading derivatives (F&O), and more. Because trading involves fees — brokerage, regulatory costs, taxes — it’s important to understand what you pay when you trade via Groww.

Let’s break down Groww’s charges as of 2025.

Groww Brokerage & Charges Structure (Stocks, F&O, Mutual Funds)

Equity (Stocks) — Delivery & Intraday

-

For equity (stock) trading, Groww charges ₹20 or 0.1% of the trade value per order — whichever is lower. (Groww)

-

There is a minimum brokerage amount for very small trades: if the brokerage computed per order comes out less than ₹5, the minimum slab applies. (Groww)

-

This means that whether you buy and hold (delivery) or trade and sell on the same day (intraday), the same rule applies. (Groww)

So for example:

| Trade Value | 0.1% of Value | Which is Lower? | Brokerage Charged |

|---|---|---|---|

| ₹10,000 | ₹10 | ₹10 < ₹20 | ₹10 |

| ₹50,000 | ₹50 | ₹20 < ₹50 | ₹20 (capped) |

| ₹2,000 | ₹2 | ₹2 < ₹5 | ₹5 (minimum) |

This model is pretty straightforward for equity investors.

Futures & Options (F&O)

If you do derivatives trading (Futures or Options) using Groww:

-

Brokerage is flat ₹20 per executed order for F&O trades. (Groww)

This simplicity (flat fee) helps derivative traders easily estimate costs before placing orders.

Mutual Funds

-

If you invest in mutual funds via Groww — either lump sum or via SIP — there is no brokerage charge. (Groww)

-

Also, account opening (for trading & Demat) and maintenance (AMC) are free. (Groww)

So mutual fund investors on Groww avoid brokerage — one major advantage.

What Other Charges to Expect (Beyond Brokerage)

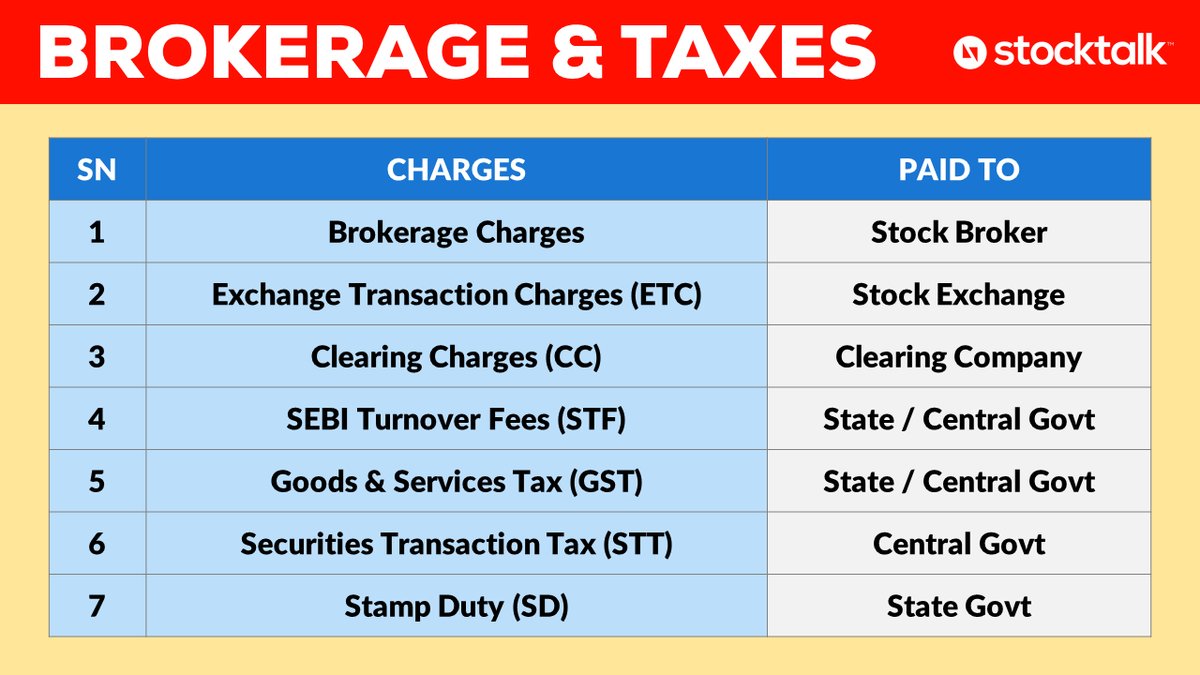

Brokerage is only part of the total cost. Groww also notes several “statutory & regulatory” and other charges that come into play depending on your transaction type. (Groww)

Here are the common additional charges:

-

STT / CTT (Securities Transaction Tax / Commodity Transaction Tax) — applicable depending on buy/sell and segment. (Groww)

-

Exchange transaction / turnover charges — small fractional percentage of trade value imposed by stock exchanges. (Groww)

-

Stamp duty — small duty on buy orders (varies by state), which goes to the government. (Groww)

-

GST (Goods and Services Tax) — 18% on brokerage and some other charges. (Groww)

-

Depository Participant (DP) charges — applicable when shares are dematerialized or transferred from Demat. (Groww)

-

Penalties / Other charges — e.g., if you use margin/trading‑fund (MTF), there could be interest on funded amount; for open intraday positions not squared‑off, auto square‑off penalties may apply (on certain trades). (Groww)

Because of these extra charges, the “real cost” of a trade can be a bit more than just the brokerage fee.

Pros & Cons of Groww’s Pricing: When It’s “Cheap”, When It’s “Costly”

👍 What is Good

-

Low flat brokerage for small and medium trades (₹20 or 0.1% cap) — useful if you trade moderate volumes often.

-

Free account opening & demat maintenance — no AMC or hidden recurring fees.

-

No brokerage for mutual fund investments — great for long‑term investors preferring SIP/lump sum MF investing.

-

Simple, transparent fee structure (on paper) — easy to calculate brokerage per order before placing trade.

⚠️ Where Users Should Be Careful

-

For very small trades (low value trades), although the fee structure seems proportional (0.1%), minimum charge kicks in — so small investors may pay relatively higher percentage.

-

Additional statutory and regulatory charges plus taxes (GST, STT, stamp duty) add up — so total cost may exceed what you expect from just brokerage.

-

If you trade derivatives, or use margin/MTF — cost structure may become complicated and overheads may rise (interest on funding, penalties, etc.).

-

Frequent small trades vs buy-and-hold: frequent small trades may erode returns due to repeated charges.

What Has Changed / What to Watch Out For

-

According to one recent review (2025), Groww continues with “₹20 or 0.1% whichever is lower, minimum ₹5” for equity trades. (Groww)

-

There have been user concerns (on forums) about “hidden” or “minimum” brokerage changing quietly — some users mention a minimum brokerage of ₹2 per order earlier, later rising to ₹5. > “Groww recently introduced a minimum brokerage fee of Rs. 2 per executed order.” (reddit.com)

-

For very small-value orders, this means a larger relative cost — so investors must check trade‑by‑trade.

Bottom line: Always check the “contract note” bill after trade — not just the brokerage estimate — to confirm all charges (brokerage + taxes + statutory fees + GST) before concluding the trade was “cheap.”

Who Should Use Groww — Based on Their Strategy

| Investor Type / Strategy | Is Groww Good / Not Ideal? | Why / Why Not |

|---|---|---|

| Long‑term mutual fund investors (SIP / lumpsum) | ✅ Good | No brokerage or AMC fees for mutual fund investments. |

| Medium to large equity trades (delivery) | ✅ Good | Flat or capped brokerage helps keep costs reasonable. |

| Frequent small trades / small investors | ⚠️ Beware | Minimum brokerage + extra charges may eat returns. |

| Intraday traders / derivatives (F&O) | ⚠️ Mixed | Flat ₹20 brokerage is ok, but taxes, regulatory fees, margin costs, and auto‑square off penalties can add up. |

| New investors / buy-and-hold | ✅ Good | Low maintenance, simple fee structure, transparent pricing. |

Tips to Use Groww More Cost‑Effectively

-

Bundle trades — instead of many small trades, try to aggregate and trade larger amounts to stay within lower per‑trade brokerage percentage.

-

Prefer delivery/trading over time, not frequent small trades — reduces impact of fixed/ minimum brokerage + taxes.

-

Use mutual funds for SIPs/lumpsum — avoid brokerage altogether.

-

Before placing any order, use Groww’s “Brokerage Calculator” to estimate full cost (brokerage + taxes + other fees). (Groww)

-

Check contract notes/transaction statements carefully, especially if trade value is low, or if you do derivative trades / margin trading.

Conclusion

Groww offers a fairly competitive and transparent brokerage structure for equity and F&O trades, and makes mutual funds very accessible without brokerage or maintenance fees. For many investors — especially medium‑to‑large trades, or mutual‑fund investors — it’s a cost‑efficient platform. However, small investors or frequent traders must be mindful of minimum brokerage, taxes, and statutory charges, which can reduce net gains.

In short: Groww can be “cheap and efficient” — but only if used smartly. Understanding all charges (not just brokerage) is key before executing trades.