Learning to budget can feel overwhelming when you start, but with a few simple strategies and a little discipline, you can build a strong financial habit that helps you save, avoid debt, and reach your goals. In this blog post I’ll walk you through easy‑to‑apply budgeting tips — explained in plain language.

Why Budgeting Matters

First, a budget helps you answer a simple but important question: Where is your money going? Without a budget, it’s easy to lose track of small expenses (like coffee, snacks, or online subscriptions) which — over time — add up and drain your savings.

A budget also helps you plan for the future: saving for emergencies, investing in your goals (like education, travel, a home, or retirement), and avoiding unnecessary debt. When you know exactly how much you earn and spend, you can make smarter choices.

With good budgeting, you can reduce financial stress, stop living paycheck to paycheck, and cultivate financial stability and freedom.

Start by Tracking Your Income and Expenses

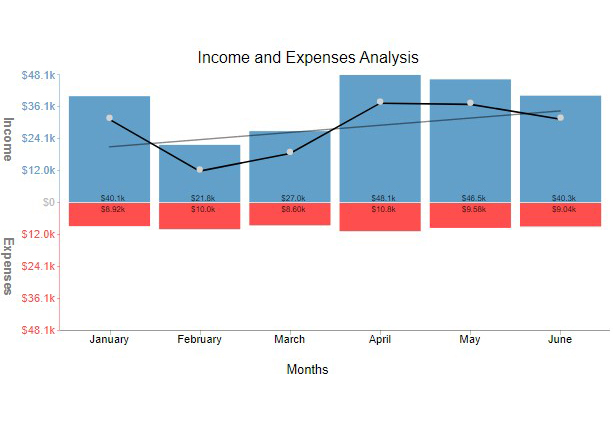

Before you create any budget, you need to know two key numbers: how much money you get (income) and how much you spend.

Begin by writing down every source of income — salary, freelance work, side‑jobs, gifts, etc. Then, for a month or two, track all your expenses: rent or house‑related costs, groceries, electricity, transport, entertainment, eating out, shopping, subscriptions, and small everyday purchases. (Consumer Financial Protection Bureau)

Tracking your expenses helps you see where your money goes, often revealing surprising leakages — like frequent coffee purchases, subscriptions you don’t use, or impulse buys. With that awareness you can cut or adjust unnecessary spending.

Many experts suggest starting with a weekly or monthly spending log, using a notebook, spreadsheet, or a simple app. (Consumer Financial Protection Bureau)

Choose a Budgeting Method that Fits You

Once you know your income and expenses, it’s time to pick a budgeting method. Here are some beginner‑friendly approaches:

1. The 50/30/20 Rule

This is one of the simplest budgeting frameworks. Allocate around 50% of your income to essential needs (like rent, groceries, bills), 30% to wants (dining out, entertainment, shopping), and 20% to savings or debt repayment. (Clever Fox®)

This rule offers an easy-to-follow guideline without needing detailed tracking — perfect if you’re new to budgeting.

2. Zero‑Based Budgeting

Here, every rupee (or dollar) of income is assigned a job: expenses, savings, bills, or fun. By the end of the month, ideally, your income minus your expenses equals zero. Nothing is left “floating.” (Kotak Bank)

This method gives you more control and awareness — but requires more effort and discipline because you need to plan ahead and assign values for every expense.

3. Envelope (Cash‑Based) Budgeting

In this traditional approach, you withdraw cash for variable expenses (like groceries, entertainment, shopping), put each portion in a labeled “envelope,” and once the money is gone, you stop spending for that category. (Wikipedia)

This is especially helpful if you tend to overspend using credit/debit cards, because physical cash limits force you to stay within budget.

You can choose — or combine — any methods above depending on your lifestyle, income stability, and spending habits.

Prioritise Savings: “Pay Yourself First”

A powerful mindset shift when budgeting is to save first, spend later. Instead of spending first and trying to save whatever remains, decide at the start of each month that a fixed portion of your income goes straight to savings (or debt repayment), before you pay for anything else. (PlanetSpark)

This ensures you don’t treat saving as leftover luxury — but as a priority. Over time, even small monthly savings can build into a meaningful amount for emergencies or future goals.

If possible, set up your bank or payment system so that this saving happens automatically (automatic transfer to a savings account, or automatic investments). This removes the temptation to spend first. (Clever Fox®)

Cut Unnecessary or Recurring Small Expenses

Often, it’s not big buys — but many small, recurring expenses that drain your wallet without you noticing.

Maybe you buy coffee outside several times a week. Or you have multiple streaming subscriptions, each costing small amounts. Maybe you use auto‑rickshaws daily, or dining out often. These can add up significantly over a month. (rupeenest.com)

Review your spending log and look for patterns: small recurring costs that don’t add real value. Cancel or reduce what you don’t need. For example, cut down on takeaway meals, or switch to cheaper transport, or reduce subscriptions. The savings might surprise you.

Plan for Both Regular and Irregular Expenses

A budget should account not only for fixed monthly bills (rent, utilities, groceries) but also for occasional or irregular expenses — like medical bills, car repairs, festivals, gifts, or a big purchase you plan later.

To handle this, divide large or irregular expenses into small amounts each month and set them aside. That way you don’t get thrown off when such expenses arrive. (Nerobudget)

This approach helps you stay prepared instead of being caught off guard by unexpected costs.

Review and Adjust Your Budget Periodically

Life changes — maybe you get a raise, or your expenses change. Because of that, a budget shouldn’t be set once and left untouched.

At the end of each month (or every few months), review how you spent your money, compare with your budget plan, and adjust. Maybe your costs for food went up, or you are saving more, or want to change your savings goal — update accordingly. (westernunion.com)

A flexible budget that adapts with your real financial situation is far more useful than a rigid one that doesn’t reflect reality.

Build an Emergency Fund — Safety First

One of the most important purposes of budgeting is to build a safety net. Aim to save some amount regularly to build an “emergency fund” — enough to cover several months of basic expenses (or whatever feels right given your life). (FinCalC Blog)

This fund protects you against unexpected situations such as illness, sudden job loss, or urgent expenses. It provides peace of mind and financial security.

Even if you start small (just a modest amount every month), consistency matters more than size when you’re beginning.

Be Realistic and Include “Fun Money”

Budgeting doesn’t mean cutting out all enjoyment. If your budget is too restrictive, it becomes hard to maintain. That often leads to giving up.

So it’s okay — even necessary — to include a small portion of “fun money”: for entertainment, hobbies, outings, or little treats. This helps you stick to the budget without feeling deprived. (Nerobudget)

A budget should support your lifestyle and values, not make you feel miserable. A realistic plan gives room for both responsibility and enjoyment.

Build the Habit — Consistency Beats Perfection

Finally, the most important tip: treat budgeting like a habit. It won’t work if you try once and give up.

Start simple: track a month, create a budget using a method that feels natural, and reflect monthly. Over time you’ll learn where you can cut back, where to save more, and how to plan for future goals.

The goal is progress — not perfection. Even small changes to how you handle money can pay off significantly in the long run.

Simple Sample Budget for Beginners (Hypothetical Example)

Suppose you earn ₹50,000 a month. Here’s how a simple budget might look using the 50/30/20 rule:

-

₹25,000 → Needs (rent, groceries, utilities, commuting)

-

₹15,000 → Wants (eating out, movies, hobbies, shopping)

-

₹10,000 → Savings / Debt repayment / Emergency fund

As you track and review, you might discover that your “wants” section can be trimmed — maybe you can reduce eating out or subscription services — and move more to savings.

Alternatively, you could start with a “save-first” plan: automatically transfer ₹8,000–₹10,000 to savings as soon as you get paid, then use the rest for expenses and wants.

Final Thoughts

Budgeting isn’t about depriving yourself — it’s about giving yourself choice. When you know where every rupee goes, you have the power to decide: whether you want to spend, save, or invest.

For beginners, the key is to start simply. Track your income and expenses, choose a method that works for you (like the 50/30/20 rule, zero-based budgeting, or envelope system), save first, plan for emergencies, and review regularly. Make room for fun, stay realistic, and build the habit.

Over time, these habits will help you avoid financial stress, build savings, and focus on what truly matters — your long‑term goals.