Why it’s good to start small — and early

You don’t need a lot of money to begin investing. In fact, starting with a small sum can be a smart way — especially if you are young, just earning, or want to learn how investing works without risking too much. Experts say even tight budgets can work: you just need a thoughtful plan. (Encyclopedia Britannica)

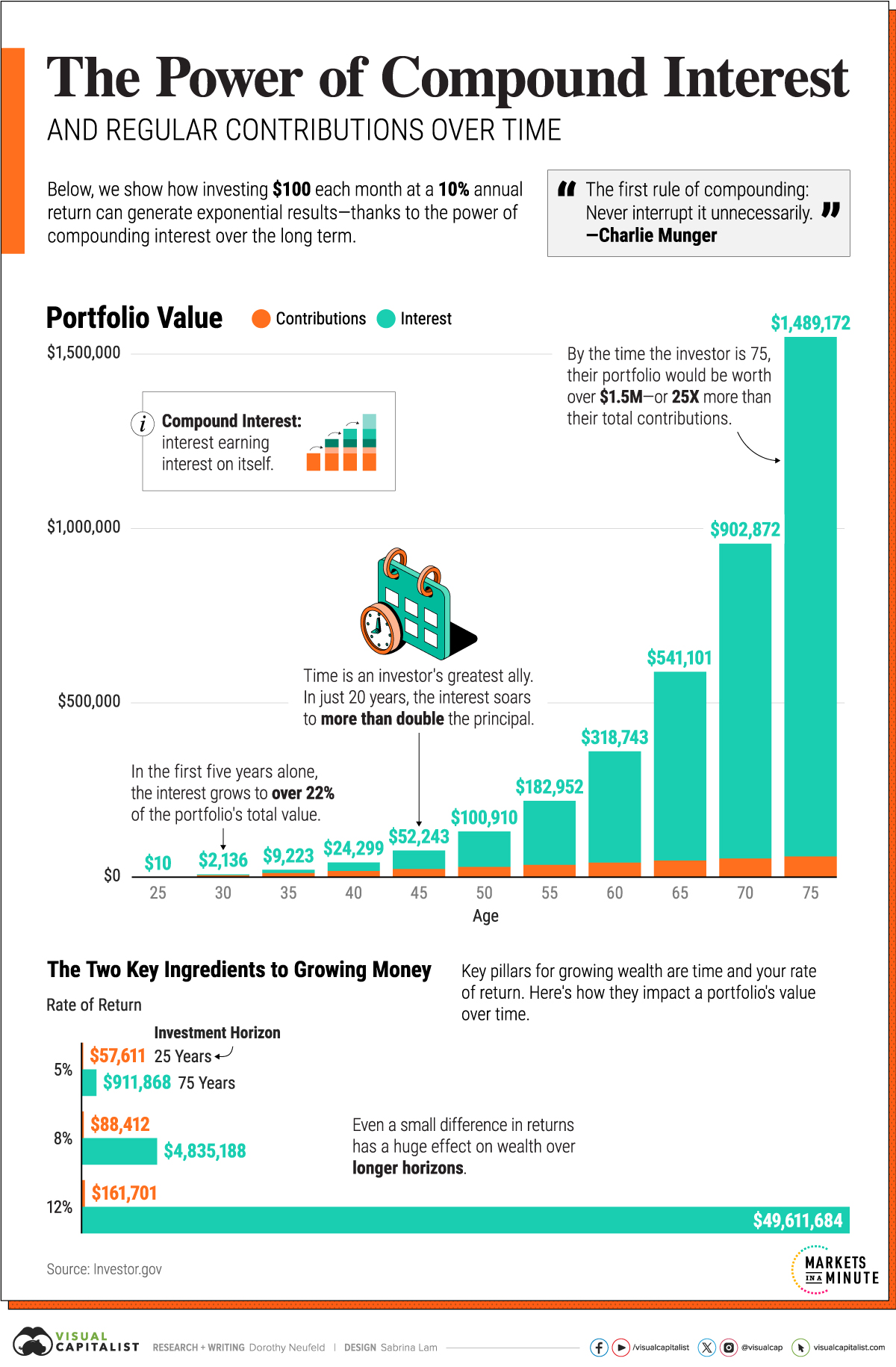

The key advantage of starting small is the power of time. If you begin investing early and keep at it consistently, even modest investments can grow significantly over the years — often more than you’d expect.

Also, investing small reduces pressure: you don’t need to worry about “putting a big lump sum and risking it all.” Instead, you build a habit, learn gradually, and can raise your investment as your income rises.

Step 1: Set Up a Financial Safety Net First

Before you think about investing, it’s wise to ensure you have some savings for emergencies. Many investment advisors suggest keeping aside enough money to cover 3–6 months of living expenses in a savings account or liquid fund. (Encyclopedia Britannica)

Why? Because unexpected things — medical emergencies, job loss, urgent repairs — can happen. If you don’t have an emergency fund, you may end up withdrawing from your investments at a bad time, which can hurt your returns.

Once that safety cushion is in place, you can begin investing with more peace of mind.

Step 2: Choose Smart, Low‑Cost, Easy‑Access Investment Options

When you’re starting small, avoid complicated or expensive investment routes. Instead, pick options that allow you to invest little by little, with low fees and less risk. Here are some good choices, especially in India.

- SIPs in Mutual Funds

One of the easiest ways for small investors is a Systematic Investment Plan (SIP). With SIP, you invest a fixed amount regularly (monthly, quarterly, etc.), often as low as ₹500 per month. Over time, these small amounts accumulate. (Tata Capital Moneyfy)

If you prefer higher growth (and are okay with some risk), you can choose equity mutual funds. If you want stability and lower risk, debt or balanced funds are safer. (Tata Capital Moneyfy)

- Recurring Deposits (RDs) and Government-backed Funds

If you want guaranteed returns with almost no risk, you can try safer options like Recurring Deposits or government‑backed savings schemes. For example, a recurring deposit lets you put a small fixed amount each month, and after a predetermined time, you get fixed returns. (think2invest.in)

Another option is a long-term safe scheme like the Public Provident Fund (PPF). PPF lets you invest small amounts (even a few hundred rupees a year), and gives compounded, risk-free returns over the long term. (Tata Capital Moneyfy)

- Digital Gold

If you like the idea of gold but don’t want to buy physical gold (which can be costly and needs safe storage), you can try digital gold. Some platforms let you invest very small amounts (as little as ₹50 or ₹100) and accumulate gold over time. (think2invest.in)

This can be a simple way to build a gold holding without the hassle of physical storage.

- Stock Market — Shares or ETFs / Index Funds

If you are a bit more comfortable with risk and want potential higher returns, you can invest directly in shares (stocks) of companies, or go for low-cost diversified options like index funds or exchange‑traded funds (ETFs). (Encyclopedia Britannica)

With modern platforms and brokers offering small‑amount investing, you don’t need large capital upfront. So even a small amount can get you started. (APSense)

Step 3: Invest Regularly — Don’t Try to Time the Market

One of the biggest mistakes beginners make is trying to pick the “right moment” to invest (when the market is low) or “sell high”. That often leads to stress, mistake‑driven decisions or missed opportunities.

Instead, a better approach is to invest a fixed small amount regularly — a method known as rupee‑cost averaging. By doing this, you buy more units when prices are low and fewer when prices are high. Over time, this evens out the cost and reduces the risk of bad timing. (HDFC Bank)

Even if you miss an investment in a month, try to make up for it in a later month — that helps maintain discipline and long-term growth. (India Infoline)

Step 4: Diversify — Don’t Put All Eggs in One Basket

When working with small amounts, it’s tempting to put everything into one investment (say, one stock or one fund), but that increases risk.

Instead, spread your investments in different assets — maybe a mix of mutual funds (equity + debt), some digital gold, maybe a small direct stock investment, or government savings schemes. This mix helps balance risk: if one asset does poorly, others may offset it. (5paisa)

Diversification becomes even more important when your capital is small, because a single bad investment can significantly dent your portfolio.

Step 5: Keep Costs Low — Fees Matter, Especially When Investing Small

When you start with small amounts, fees and charges (brokerage, fund expense ratio, transaction costs, account maintenance) can eat into returns substantially.

So choose platforms or funds with low costs. For example, pick mutual funds or ETFs with low expense ratios. Or use brokers/ apps that allow small‑amount investments and don’t charge high fees. (IFC Markets)

By doing so, you ensure more of your invested amount actually works for you — rather than getting wasted in fees.

Step 6: Be Patient and Think Long-Term

Investing with small amounts is not meant for quick riches. The true magic happens over years, or even decades.

Often, you won’t feel much difference in the short term — returns might be modest, or even fluctuating — but if you stay invested, reinvest dividends, and keep contributing regularly, your wealth will grow steadily.

Also, over time, you can gradually increase your investment amount as your income grows. What matters is the habit of investing, discipline, and long-term thinking.

What You Should Do — A Simple Plan for Beginners

Here’s a sample plan you can follow if you’re just starting out:

-

First, build an emergency fund — enough to cover 3–6 months of expenses.

-

Decide a monthly amount you’re comfortable investing — maybe ₹500, ₹1,000 or more depending on your income.

-

Start a SIP in a mutual fund (equity or balanced) — this builds habit and uses rupee‑cost averaging.

-

Consider adding small portions to safe investments — like PPF or recurring deposits, for stability.

-

If you like gold, put a little in digital gold rather than physical, to avoid storage issues.

-

As you learn more and grow confident, maybe invest small amount in ETFs or stocks for potential higher returns.

-

Review your investments once or twice a year, and increase the monthly amount if possible.

Common Mistakes to Avoid

-

Don’t wait for the “perfect time.” Markets fluctuate — if you wait for “just right moment,” you may never start.

-

Avoid putting all money in a single “hot tip” stock — that’s risky. Diversify.

-

Don’t ignore fees — high brokerage or fund fees can eat away a big chunk when your investment amount is small.

-

Don’t panic when markets dip. Short-term fluctuations are normal. Stay calm and stay invested. (India Infoline)

Final Thoughts

Starting to invest with a small amount is not only possible — it’s smart. It helps you build a good habit, gives you a learning curve, and with consistent effort over time, can grow into a substantial amount.

You don’t need to wait for a big salary or large savings to begin. Even with ₹500 or ₹1,000 per month, by choosing smart investment options, staying consistent, and being patient, you can build wealth — slowly but steadily.