In recent years, many Indian investors — beginners and experienced both — have turned to Groww to invest in mutual funds, stocks, and other financial instruments. But with growing use comes the important question: Is Groww really safe? In this post, we explore Groww’s strengths, shortcomings, user feedback and — crucially — what you, as an investor, need to know to stay safe.

Why Groww Claims It Is Safe

First, let’s look at the security and compliance features that Groww emphasises. These form the foundation of its safety.

-

Regulated and legitimate broker/depository participation: Groww states that it is a registered stock broker and a Depository Participant (DP) under CDSL, and is regulated by Securities and Exchange Board of India (SEBI). It also claims membership with major Indian stock exchanges (like National Stock Exchange of India — NSE, and Bombay Stock Exchange — BSE). (Groww)

-

Data protection and security layers: According to third‑party reviews, Groww uses encryption for data transmission and storage, meaning sensitive information (like personal data, bank details, transactions) is scrambled so that outsiders can’t easily intercept or read it. (equity indian Stock Market)

-

Optional security features like Two‑Factor Authentication (2FA): Groww offers (and strongly recommends) enabling 2FA. With 2FA, even if someone gets hold of your password, they’d still need a second form of verification (like OTP on your mobile) to log in — which significantly reduces the risk of unauthorized access. (equity indian Stock Market)

-

Transparent transaction flow (for mutual funds): Groww claims that when you invest in mutual funds via the app, the money doesn’t sit with Groww. Instead it moves directly from your bank account to the clearing house, then to the fund house, abiding by SEBI/the exchange’s rules. That means Groww doesn’t “hold” your money in a pooled account. (Groww)

-

Reputation & user base: Groww highlights that millions of users across India trust the platform, which — for many — is a comfort factor when investing. (Groww)

In short: on paper — Groww has the regulatory approvals, technical safeguards, and a transparent fund-flow model that make it a reasonably secure investment platform.

What Users and Observers Say — Pros & Cons

No platform is perfect. Alongside praise, Groww has received both appreciation and criticism from users and independent reviewers. Here’s a summary of what people are saying.

✅ What users like

-

Many find Groww’s interface simple and easy to use, especially for beginners. According to one review site, “Groww app is fast and simple for new man in stock market.” That simplicity attracts new investors who don’t want complicated trading platforms. (beliebteapps.com)

-

For long‑term investors, especially in mutual funds, Groww’s low-cost model (free account opening, minimal or no maintenance fees) is viewed positively. (beliebteapps.com)

⚠️ Complaints, glitches, and reported issues

-

Some users have reported technical glitches or delay in execution, especially for active trading. For example: orders not executing properly, or stop‑loss triggering incorrectly. In one thread:

“My stop-loss gets hit most of the time even when the candle doesn’t actually reach that level … charts are very frustrating and unreliable.” (reddit.com)

-

Customer support has been criticized: slow responses, unhelpful replies or no real resolution. As one user wrote:

“Their customer service is practically non‑existent. I’ve been going in circles with HUMAN replies and no real resolution.” (reddit.com)

-

Some investors claim that after IPOs, or during high‑volatility times, issues like delayed mutual‑fund NAV updates, wrong portfolio values, or mis‑synchronisation with fund houses (RTAs) have occurred. Such discrepancies — though sometimes corrected later — undermine confidence. (beliebteapps.com)

-

As with any online platform, there’s ongoing risk of phishing scams or fake messages pretending to be from Groww — promising “guaranteed returns” or “premium tips.” Groww itself warns users about such fraudulent messages. (Groww)

-

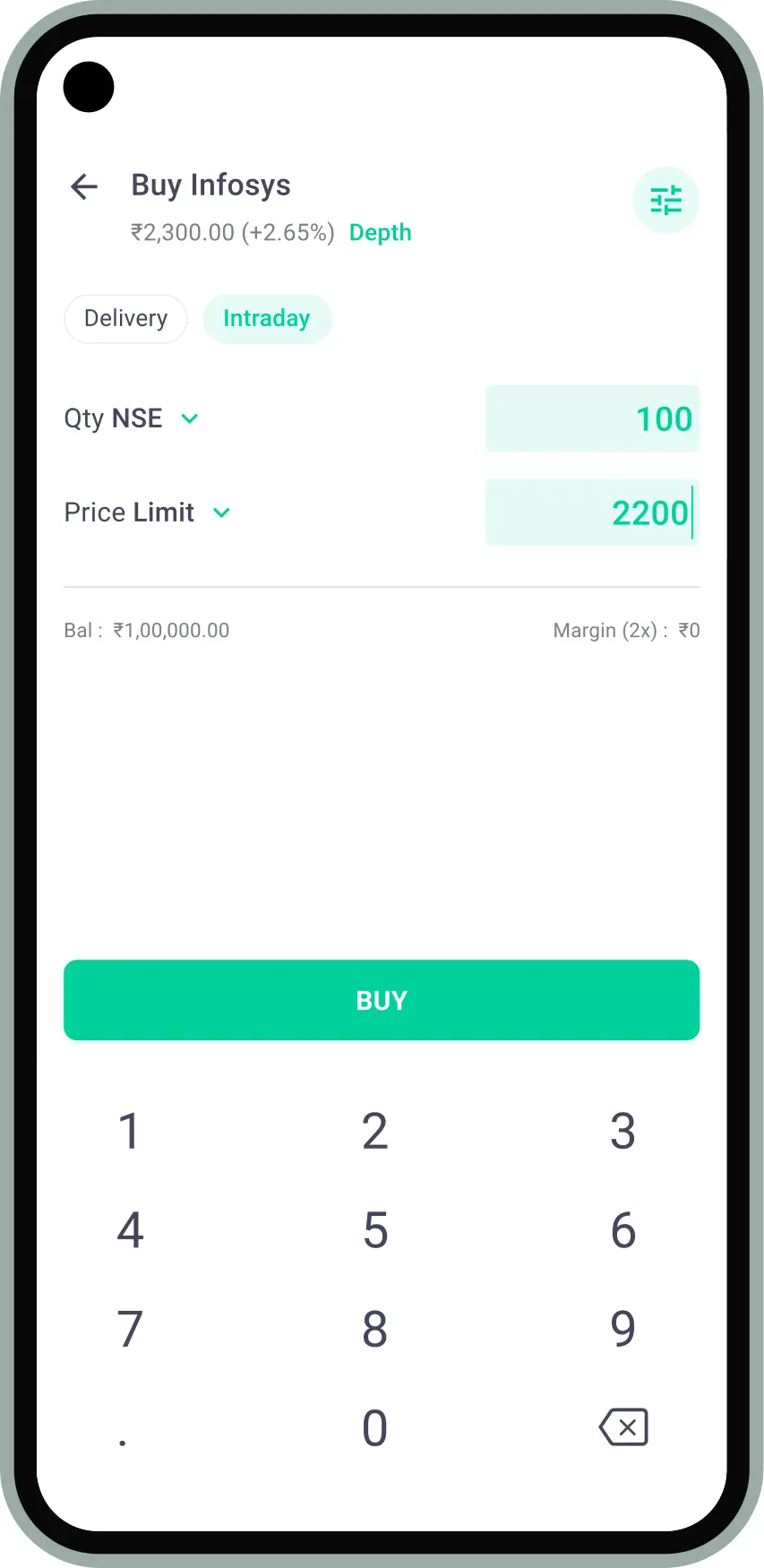

Some critics argue that while Groww may be fine for mutual funds and long‑term investing, it's not ideal for heavy intraday or frequent trading due to fewer advanced features compared to traditional or full‑fledged brokers. (Day Trade India)

So real user experiences — especially among active traders — seem mixed.

What Are the Real Risks — And How to Stay Safe

Understanding that no platform is 100% risk‑free, here are the main risks to watch out for, and how you can mitigate them while using Groww (or any similar investment app).

🔐 Platform + Cybersecurity Risks

-

Phishing and impersonation scams: Some scammers use Groww’s name/fake logos to lure users into “premium tip groups” or send fake links. Always treat unexpected messages or offers with caution. Groww itself advises users never to trust such external messages. (Groww)

-

Account compromise: If your password is weak or you reuse it elsewhere, there’s risk of unauthorized access. That’s why enabling 2FA is essential. (equity indian Stock Market)

-

Technical glitches & data sync issues: Because Groww handles many transactions and fetches data from stock exchanges / fund‑house RTAs, sometimes delays or mismatches may happen. That can cause temporary wrong portfolio balances or delays in NAV updates. (Groww)

📉 Market & Investment Risks (Not Groww’s fault!)

-

Market volatility: The value of stocks or mutual funds can go up or down. Groww — or any broker/app — cannot guarantee profits. (Market Insights India)

-

Misuse of third‑party advisors / fake portfolio managers: Some people might impersonate advisors claiming to be associated with Groww and promise high returns. Groww clarifies it does not have in-house portfolio managers; any such claim is fake. (Groww)

✅ How You Can Stay Safe (Best Practices)

If you choose to use Groww (or any investment app), these tips can help protect you:

-

Use a strong, unique password — different from other accounts.

-

Enable 2FA / OTP verification for login and transactions.

-

Do not trust external investment‑tips or “guaranteed returns” shared via WhatsApp, Telegram, or social media — especially if they claim to be from Groww.

-

Avoid using public or shared devices for trading/investing, or if you do, always log out afterwards. Groww recommends using your own device. (Groww)

-

Regularly cross‑check your holdings and transactions (e.g., with fund‑house RTA statements, or via your bank account) — especially after big transactions or SIPs.

-

Treat investing as a long‑term activity — avoid treating it like gambling; don’t expect guaranteed profits. Be prepared for ups and downs in market value.

Should Beginners Trust Groww? What Kind of Investor Is Groww Good (or Not Good) For

From the evidence and user feedback, here’s when Groww makes sense — and when you might want to be more cautious or consider alternatives.

When Groww is a good fit:

-

If you are a beginner investor wanting to start with mutual funds, long‑term SIPs, or simple stock investing. Groww’s clean interface, transparency, and zero‑maintenance cost make it attractive.

-

If you don’t trade actively and are comfortable with medium-to-long‑term investing — your holdings don’t require frequent intraday trades.

-

If you follow safe online habits (secure password, 2FA, avoid shady tips) and periodically check your account statements for accuracy.

When Groww may not be ideal:

-

If you are an active trader doing intraday trades, frequent buys/sells, or need advanced charting/trading tools — some users have reported glitches, delays, or poor reliability for such use.

-

If you are prone to panic–sell/buy based on rumours — the market is volatile, and using social media tips or “too‑good‑to‑be‑true” schemes can be risky.

-

If you cannot regularly monitor your holdings or reconcile with fund‑house statements — occasional data sync issues mean you need to stay vigilant.

Final Verdict — Groww Is Relatively Safe, But Use With Caution

On balance, Groww appears to be a relatively safe and legitimate platform for investing — especially for mutual funds and long‑term investors. It is regulated, uses standard security practices, and claims to follow transparent fund flow mechanisms.

That said — “safe” does not mean “risk‑free.” There are real issues: occasional technical glitches, delays, user complaints about customer support, and the ever‑present risk of scams or phishing. The safety of your investment also depends heavily on how wisely you use the platform.

If you’re starting out or investing for the long term — Groww can be a good choice, provided you follow best practices (strong password, 2FA, avoid shady tips, cross‑verify transactions). If you plan frequent trading or look for advanced features, you may want to compare other brokers or apps before committing.

What to Watch Out For — My Suggestions for You

Since you (as a user) are reading this — here are some personal suggestions when using Groww:

-

Treat every investment as medium/long-term — don’t expect quick gains or treat it like gambling.

-

Always double‑check your holdings — especially after SIPs or fund purchases. If something looks odd (e.g. NAV mismatch), check with fund‑house statements.

-

Never trust external “tips”, “group recommendations”, or links from social‑media claiming high returns.

-

Use security features: enable 2FA, logout when not using, avoid shared devices.

-

Diversify — don’t keep all investments in one platform or one type of asset.