If you invest in stocks or IPOs via Groww — or plan to — you might have come across a strange term: BO ID. For a beginner, it may seem confusing. But don’t worry: BO ID is simply a technical term, and once you understand it, it will give clarity about how your shares are held, tracked, and managed. In this article, we’ll explain what BO ID means, why it matters (especially on Groww), how to find it, and in what situations you’ll need it.

What is BO ID?

-

BO ID stands for “Beneficial Owner Identification Number” (sometimes you’ll see it as “Beneficiary Owner ID/Identification Number”). (RetireWithRohit.com)

-

Essentially, BO ID is the unique number assigned to your demat account — your electronic account that holds your shares, mutual funds (in demat mode), and other securities. (Groww)

-

In platforms like Groww — which work as depository participants through the central depository (usually CDSL) — every user with a demat account gets one unique BO ID. (Groww)

So, think of BO ID like a bank account number: it tells the depository which account to credit or debit when you buy or sell shares.

Structure of BO ID: What the Digits Mean

BO ID is not random. It has a defined structure: (Lucknow Lions)

-

The first 8 digits represent the DP ID (Depository Participant ID) — this identifies your broker or depository participant (in Groww’s case, their CDSL‑registered DP ID). (Lucknow Lions)

-

The last 8 digits represent your Client ID (or unique demat account number) — assigned specifically to you under that DP. (Lucknow Lions)

-

Example: If BO ID is

13010800 15536891, then13010800is DP ID and15536891is your unique client ID. (अ डिजिटल ब्लॉगर)

Because of this structure, even if two investors use the same broker (same DP), their BO IDs will differ because of the differing client IDs.

Why BO ID Matters — What It’s Used For

BO ID plays a central role in many operations related to your investments. Here’s when and why BO ID becomes important:

-

Demat account identification: BO ID uniquely identifies your demat account among millions of accounts in the depository. Without BO ID, there would be no way to know which holdings belong to whom. (Business Standard)

-

Handling securities (buy/sell): When you buy stocks, mutual funds (in demat mode), or other securities via Groww, the holdings are directly credited to your BO ID. Similarly, when you sell or transfer, the system uses BO ID to debit from the correct account. (Groww)

-

IPO allotments: If you apply for an IPO through Groww, the BO ID tells the company/depository where to deliver the allotted shares. Without it, shares can’t be credited to your demat account. (RetireWithRohit.com)

-

Security & verification (TPIN, holdings verification): For regulatory and security reasons, depositories often require verification via a Transaction PIN (TPIN). Your BO ID helps depositories confirm the correct demat account before allowing share transfers or sales. (Lucknow Lions)

-

Corporate actions: When companies declare dividends, bonuses, rights issues — or other corporate actions — credit must go to correct investors. BO ID ensures you get your rightful benefits. (5paisa)

In short: if you treat your demat account as the “home” for your shares, BO ID is the “address” of that home.

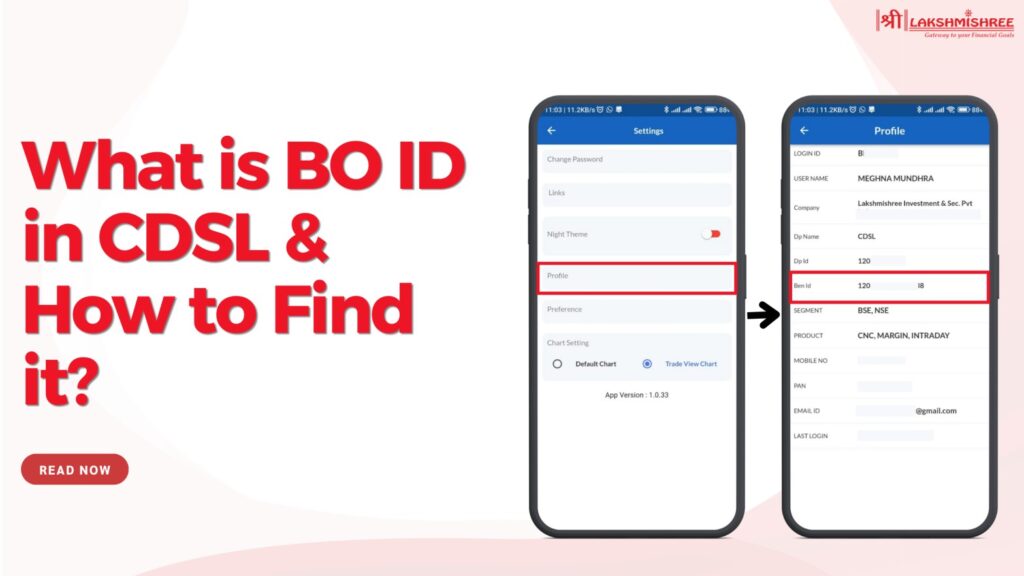

How to Find Your BO ID in Groww

If you have a Groww demat/trading account and want to know your BO ID, here’s how you can easily find it:

-

Open the Groww app (or website) and log in. (Groww)

-

Tap on your profile icon (or go to the “You” / Account / Profile section). (Groww)

-

Go to “Account Details” (or “Demat Details / Demat Account Number”). (Groww)

-

There you will see a 16‑digit number labeled as “Demat Account Number / BO ID”. That’s your BO ID — combination of DP ID (first 8) + client ID (last 8). (Groww)

Alternatively, you can also find BO ID in the welcome kit when your demat account was opened, or in periodic statements sent by the depository (like CAS — Consolidated Account Statement). (Groww)

BO ID on Groww vs Demat Account: Are They Same?

Sometimes people get confused between “demat account number” and “BO ID”. On Groww (and most brokers using CDSL), they are effectively the same. The BO ID is the demat account number. (RetireWithRohit.com)

-

Demat account number = 16‑digit BO ID (DP ID + Client ID)

-

When you are asked for “demat account number” or “BO ID / Beneficial Owner ID” — you must give the full 16 digits.

So there’s no separate “demat number” and “BO ID” — they refer to the same identifier.

Common Use‑Cases Where You Need Your BO ID

Here are a few common situations in Groww or generally in stock market / demat‑account usage where you may be asked for your BO ID:

| Scenario | Why BO ID matters |

|---|---|

| Applying for IPO via Groww | To direct allotment of shares to correct demat account (RetireWithRohit.com) |

| Selling or transferring shares | Broker and depository need to debit correct account using BO ID + TPIN (Lucknow Lions) |

| Receiving dividends, bonus, rights | Demat “owner” must be correctly identified via BO ID for corporate actions (5paisa) |

| Consolidated statements / tax or audit | BO ID helps dematerialized holdings be accurately reported in statements or tax documents (Groww) |

| Switching brokers / transfer to another demat | Other broker or depository will ask for your BO ID to link or transfer holdings (Lucknow Lions) |

Therefore — even if you open your demat account today and do nothing for months — it’s always useful to know and keep safe your BO ID.

Important Points, Misconceptions & Things to Know

-

BO ID is not PAN or UPI: While PAN identifies you tax‑wise, and UPI/payment systems identify your bank or payment address — BO ID is specifically for demat account ownership and securities handling. (Business Standard)

-

One BO ID per demat account: If you have more than one demat account (via different brokers), each will have its own unique BO ID. (Lucknow Lions)

-

Confidentiality matters: Since BO ID links to your demat account and holdings, treat it like a bank account number. Share only with trusted parties (broker, depository, or authorized parties).

-

BO ID may matter for corporate actions & legal/regulatory compliance: Whether IPO allotments, dividends, or share transfers — having correct BO ID avoids errors or misdirected shares. (5paisa)

-

Where BO ID comes from: When you open a demat account via a broker/depository participant (DP), the central depository (CDSL or equivalent) issues a BO ID by combining DP ID + a unique client ID. (Lucknow Lions)

Why Knowing About BO ID Is Especially Important for Groww Users

If you are using Groww — which offers paperless demat accounts — BO ID is your primary way to identify your demat account. Many users confuse Groww account credentials with demat account details, but when it comes to shareholding, trading, IPOs — demat account (and its BO ID) is what matters. So:

-

While Groww login gives you access to app interface — BO ID ensures your securities are parked under your name in the depository.

-

If you apply for IPOs, transfer shares, or sell — Groww will ask you to verify via TPIN for the BO ID / demat account being used. (Groww)

-

If you don’t know your BO ID (or lose track), corporate actions like dividend, bonus, rights or share allotments might get delayed or mis‑credited.

-

For compliance, audits or account statements — BO ID ensures you’re the rightful beneficial owner of securities listed under demat account.

Thus, BO ID is the backbone of your investing identity in Groww & Indian stock markets.

Conclusion — BO ID Demystified

To summarise: BO ID = Beneficial Owner Identification Number = your 16‑digit demat account number. On Groww, it uniquely identifies your demat account with CDSL — combining a broker‑level ID (DP ID) + your client ID. It’s needed for almost every significant action: IPOs, buying/selling shares, transferring to other brokers, receiving dividends or corporate benefits.

If you’re new to investing or sometimes feel confused by stock‑market jargon, just remember this: whenever you see “BO ID” or “Demat Account Number / Demat Details” — think “this is my demat‑account’s bank account number, used to hold and track all my investments”.

So next time you log in to Groww, go to Profile → Account Details → Demat / BO ID, note your 16‑digit code, and store it somewhere safe. It might save you a lot of trouble later.

I hope this article gives you clarity about BO ID — and makes you more confident while using Groww (or any demat‑based broker).