If you’ve come across a “Groww app download” link — likely pointing to the official download page on Google Play Store or Apple App Store — it refers to the official mobile application of Groww, a popular investment and trading platform in India. In this blog post, I explain what Groww is, what its features are, how you use the download link, and the pros and cons — in simple, easy-to-understand English.

What is Groww?

-

Groww is an Indian online investment and trading platform. (Wikipedia)

-

It was launched in 2016 by its founders (though I will not name them individually here). (Wikipedia)

-

Initially focused on mutual funds, Groww expanded to offer a variety of financial instruments, including: stocks (on NSE/BSE), mutual funds, ETFs, IPOs, derivatives (Futures & Options — F&O), digital gold, and more. (Wikipedia)

-

Groww provides both a mobile app (for Android & iOS) and a web platform. (Investor Gain)

Groww has grown rapidly and is considered one of India’s biggest and most popular retail investment platforms. (Wikipedia)

What does the “Groww app download” link do?

-

The download link usually directs you to the official app listing on Google Play Store (for Android) or Apple App Store (for iOS). From there, you can install the app on your smartphone. (badiyatech.com)

-

After downloading, you can register, complete KYC (Know Your Customer) verification, and open a free Demat + trading account — completely online and paperless. (Groww)

-

Once your account is ready, you can start investing/trading via the app or web platform: mutual funds, SIPs, stocks, IPOs, etc. (Investor Gain)

In short — the “download link” is your gateway to begin using Groww on your smartphone to invest/trade.

Key Features of Groww

Here are some of the main features that make Groww popular: (Investor Gain)

✅ For Investors (Mutual Funds, SIPs, Long-term)

-

Invest in direct mutual funds — often with zero commission/fees. (Investor Gain)

-

Start SIPs with small amounts (some say as low as ₹500) which makes it accessible to small investors. (Groww)

-

Switch from regular funds to direct funds through Groww. (Investor Gain)

-

Easy, paperless onboarding and transparent fees/charges. (Groww)

📈 For Traders / Active Users (Stocks, F&O, IPOs)

-

Trade in Indian stocks (NSE/BSE) — both delivery and derivatives (F&O) for experienced users. (Investor Gain)

-

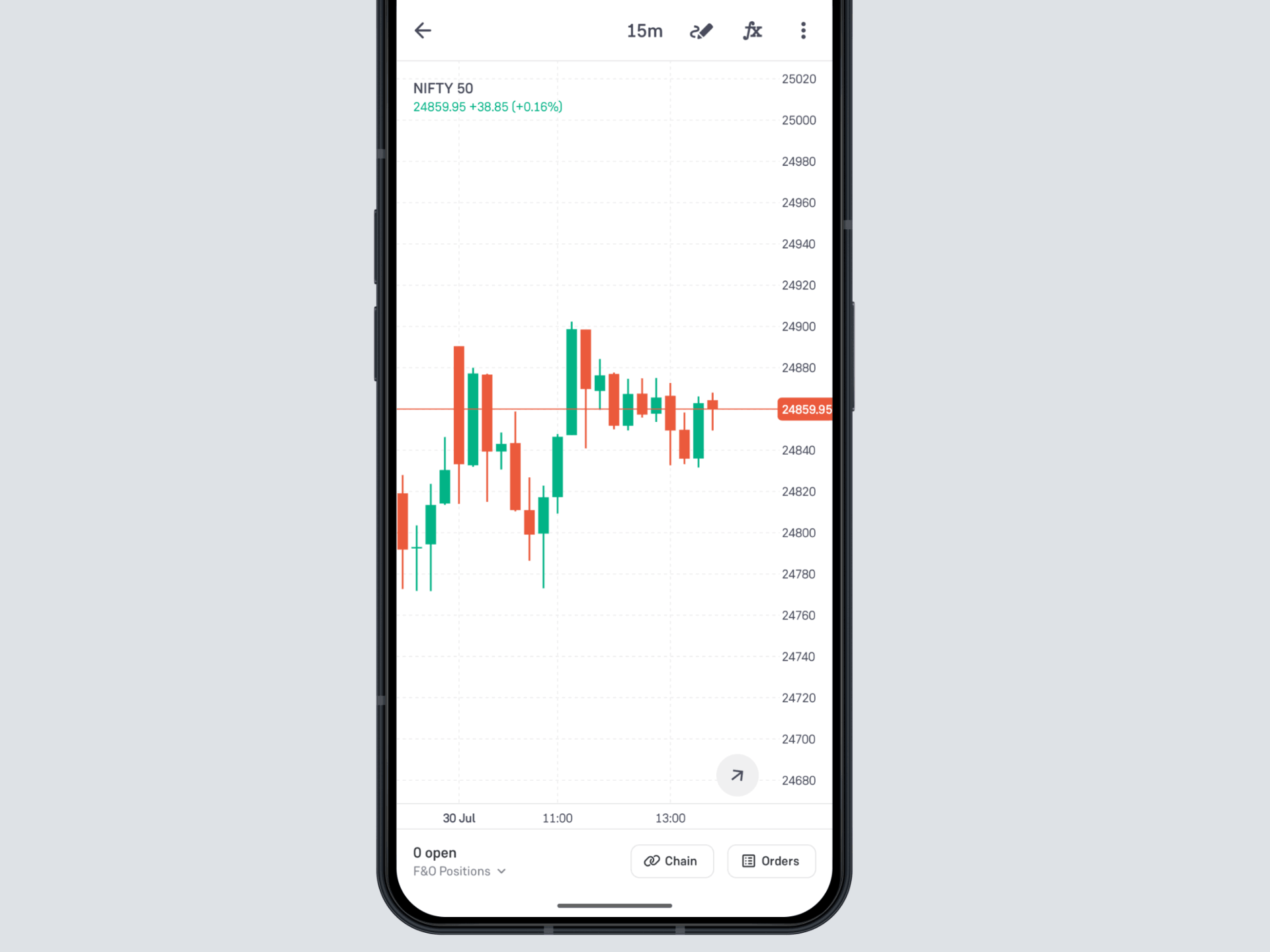

Use technical analysis tools: interactive charts (candlestick, line), long-term historical price data (up to 10 years in some cases), stock screeners, watchlists. (Investor Gain)

-

Invest in IPOs online (apply via UPI) through Groww. (Investor Gain)

-

All-in-one platform: you don’t need separate apps for mutual funds, stocks, ETFs, IPOs. Groww combines them under one roof. (Wikipedia)

🔐 Security & Usability

-

The app uses secure protocols (such as SSL encryption) and also supports biometric login (fingerprint), making it relatively secure. (Investor Gain)

-

The interface is clean, minimalistic, and user-friendly — suitable even for beginners. (NextLeap)

-

Portfolio tracking, real-time stock/index updates — all accessible via mobile or web. (Investor Gain)

What’s New: Groww Latest Developments

-

Groww recently introduced the ability to hold mutual fund units in demat form — meaning fund holdings appear like securities. This dematerialisation can make tracking, transferring, or pledging easier for users. (The Economic Times)

-

This move aligns mutual fund investments closer to how traditional stock holdings are managed, bringing more convenience and transparency. (The Economic Times)

Pros & Cons — What’s Good and Where to Be Careful

👍 Pros

-

Easy onboarding: Paperless, quick, free account + demat opening. (Groww)

-

Affordable for small investors: Low minimum amounts (e.g., small SIPs), direct funds with lower fees. (Investor Gain)

-

All-in-one: Mutual funds, stocks, IPOs, ETFs, F&O — all in one platform. (Wikipedia)

-

User-friendly & secure: Clean interface, charts, portfolio tracking, encryption, biometric login. (Investor Gain)

-

Demat-based mutual funds (new): Simplifies fund management and aligns with traditional securities. (The Economic Times)

⚠️ Cons / What to Check Carefully

-

Some users have reported technical glitches or downtime — which can be problematic especially during active trading. For example, in February 2025 there was a day when many users complained that the app was down and couldn’t login. (Moneycontrol Hindi)

-

As with any investment platform, investments carry market risks — Groww itself states that it does not guarantee fixed returns. (Groww)

-

For more advanced features (like F&O, derivatives), some risk awareness and knowledge is required — not all users may find them easy.

-

There have been some negative user reports (especially on public forums) about issues like transaction glitches, delayed KYC, or dissatisfaction with customer support. (reddit.com)

Should You Use Groww? — Who is It Good For

Groww is a good fit for:

-

Beginners who want to start with mutual funds or SIPs — easy, low cost, straightforward.

-

Medium-term investors who want a one‑stop platform for mutual funds, stocks, ETFs, IPOs.

-

Active traders who want tools like technical charts, stock screeners, and access to equities + derivatives.

-

People who like convenience — managing everything via mobile (or web), with clean interface and relatively low cost.

If you are someone who wants to experiment with F&O or more advanced trading, just be sure to learn about risks. Because investment returns are not guaranteed — and market volatility always plays a role.

How to Download Groww — Step by Step

-

Click on the “Groww app download” link (or search “Groww” on Google Play Store / Apple App Store).

-

Install the app on your smartphone.

-

Open the app and start registration — provide details for KYC verification.

-

Once KYC is complete, open your Demat + trading account (this process is paperless).

-

Start exploring: mutual funds, SIPs, stocks, IPOs — pick what you want and invest/trade.

Conclusion

The “Groww app download” link gives you access to one of India’s leading digital investing platforms. Groww blends ease-of-use with a powerful set of tools — from simple SIP investments to advanced stock and derivatives trading. For many retail investors (especially beginners), Groww offers a low-cost, user-friendly route to enter the stock market and mutual fund investments.

However — like with any investment platform — it’s important to stay informed, understand risks, and make decisions carefully. If you decide to use Groww, treat it as a tool — not a guaranteed profit machine.