Angel One is one of India’s popular platforms for investing in stocks, mutual funds, IPOs, commodities, F&O, and more. It’s widely used by both beginners and seasoned investors. In this blog post, we will analyze what Angel One offers, its features, pros & cons, and how to get started — all in simple English. This will help you understand if Angel One is the right choice for your investment journey.

What is Angel One — At a Glance

-

Angel One began as a traditional broker but has evolved into a full‑fledged digital investing platform with its “Super App” model. (Forbes)

-

The app supports investments across stocks, mutual funds (MFs), ETFs, futures & options (F&O), commodities, currency, IPOs, and more. (Angel One)

-

As of recent years, Angel One claims to have millions of users and has facilitated many investment accounts — making it one of the largest brokers in India. (Forbes)

In short: Angel One tries to be a one‑stop platform for almost every kind of investment you might want to do in India.

Key Features of Angel One App

Here are the main features that make Angel One attractive for investors:

✅ Easy & Fast Digital Onboarding

-

You can open your Demat/trading account online: just submit PAN, Aadhaar and bank details — KYC is completed digitally (often via DigiLocker) in minutes. (Angel One)

-

No paperwork or physical visits required (unless you prefer). This makes it accessible even if you're in smaller cities or towns. (Angel One)

✅ Zero / Low Brokerage & Transparent Costs

-

For equity delivery trades (buying shares for long term), brokerage is ₹0 (i.e. free). (Indian Stock Market Software)

-

For intraday trading, F&O, commodities, etc., they charge a flat ₹20 per executed order or lower of ₹20 or certain percentage (depending on the segment). (Chart Vacancy)

-

For mutual funds, there is no commission / brokerage on direct mutual fund investments. (Indian Stock Market Software)

-

Account opening is free. Demat AMC (annual maintenance charge) may be ₹0 for the first year; after that some fees may apply depending on plan. (Chart Vacancy)

-

Overall, compared to many traditional brokers, Angel One’s pricing is quite competitive and transparent. (Chart Vacancy)

✅ Wide Range of Investment Options

With Angel One, you are not limited to just stocks. You can invest in:

-

Indian equities (stocks listed on NSE/BSE) (Angel One)

-

Mutual Funds — equity, debt, hybrid, and many schemes (Angel One claims to offer thousands of MF schemes). (Angel One)

-

IPOs (initial public offerings), if you want to invest in newly listed companies. (Indian Stock Market Software)

-

Commodities and currencies (depending on regulatory permissions) (Angel One)

-

Futures & Options (F&O) for advanced / short-term traders. (Angel One)

This makes Angel One quite versatile — whether you want simple long-term investing, SIP in mutual funds, or active trading.

✅ Smart Features & Tools — Good for Beginners and Advanced Traders

-

ARQ Prime: This is Angel One’s AI-based advisory engine. It analyses historical data, risk profile, sector trends — and gives suggestions on which stocks or mutual funds might suit you. (Forbes)

-

Real-time Market Data & Charts: Angel One provides live updates from major exchanges, and includes charting tools (candlestick, line, etc.) for technical analysis. Useful for traders. (Angel One)

-

Watchlists & Alerts: You can build customized watchlists to track favorite stocks/funds and set price alerts, so you don’t miss important market moves. (One Credit Score)

-

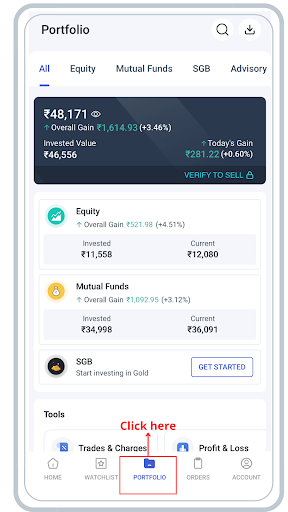

Portfolio Insights & Research Reports: Helps you track portfolio performance (gains/losses, asset allocation), compare mutual funds, and get research-based insights. (Forbes)

-

Multiple Platforms: Besides mobile app, Angel One supports web trading — helpful for deeper analysis or for those who prefer desktop trading. (Chart Vacancy)

-

Instant Fund Transfers & Withdrawal: Banking integration (UPI, net banking, etc.) to add or withdraw money, making it easy to start investing. (Forbes)

Advantages: Why Many Users Like Angel One

Putting together the features, these are the big advantages of using Angel One:

-

Great for beginners — because of easy onboarding, simple brokerage structure (free for delivery), and advisory tools (ARQ Prime).

-

One-stop shop — you don’t need separate apps for stocks, mutual funds, commodities, IPOs, etc. Everything is in one app.

-

Cost-effective — zero brokerage for delivery, no commission on MFs, flat ₹20 for other trades — good for cost-conscious investors.

-

Flexibility — suitable for long-term investors (stocks/MFs), SIP investors, or active traders (intraday, F&O) — depending on what you want.

-

Advanced tools — for those who want more than just buy & hold: live data, charts, analysis, research, portfolio tracking.

-

Accessibility across India — online KYC & account opening helps people from smaller towns or remote areas to participate easily.

Some Limitations & Criticism: What to Watch Out For

No platform is perfect; here are some drawbacks or complaints about Angel One:

-

Some users mention occasional lag or delay during market opening hours — real-time data can get slow when many use the app. (One Credit Score)

-

For advanced traders: although charts and tools exist, some find the app UI complex or cluttered (especially new users) compared to simpler apps. (Reddit)

-

If you opt for margin trading or leverage, extra care is needed — charges and risk increase. (Chart Vacancy)

-

Even though direct mutual fund investments have zero commission, associated taxes/fees and market risks remain. As always, MF returns are subject to market volatility.

-

As with any broker, transparency and understanding fees beyond brokerage (like taxes, exchange fees, etc.) is important — hidden costs can add up if you trade frequently. (Chart Vacancy)

Also, no matter how good an app is, investing always carries risk — past performance is not a guarantee of future returns.

Recent Updates & What’s New with Angel One (2024–2025)

-

In its recent annual report (FY25), Angel One launched its own mutual fund schemes (via a subsidiary), expanding from just brokerage to asset management. (Angel One)

-

The “Super App” model is being actively enhanced: more tools are being added — like fund‑comparison tools, option‑expiry modules for derivatives traders, better fund‑screeners for mutual funds. (Angel One)

-

For SIP (Systematic Investment Plan) investors, Angel One claims many users have started SIPs using their app, showing growing acceptance among retail investors. (Angel One)

These developments show Angel One is trying to stay competitive — combining old-school brokerage reliability with modern digital convenience.

Who Should Use Angel One — And Who Should Be Cautious

👍 Good For:

-

Beginners who want to start investing without complicated processes

-

People who want to invest in mutual funds via SIP or lumpsum

-

Investors who want multiple asset classes (stocks, MF, commodities, IPOs) in one place

-

Those who prefer lower costs, transparent charges, and don’t trade too frequently (delivery/investment approach)

-

Investors who value advisory tools and want help selecting funds or stocks

⚠️ Be Cautious If:

-

You are a frequent trader or day‑trader — you need to be aware of charges, margin requirements, and risks

-

You are not comfortable with volatility — especially in stocks or derivative segments

-

You expect a very simple UI or beginner‑friendly minimal interface — some features are more suited to intermediate/advanced investors

-

You rely solely on tools or robo‑advisory (like ARQ) — these are aids, not guaranteed win formulas

How to Start with Angel One — Step by Step

-

Download the Angel One app from Google Play Store / Apple App Store or visit their website and click “Open Demat Account.” (Angel One)

-

Provide basic details: mobile number, PAN, Aadhaar, bank details — and complete KYC via e‑KYC (often via DigiLocker, selfie & OTP) (Angel One)

-

Once account verified (can take a few hours), link your bank account and add funds using UPI or net banking. (Forbes)

-

Navigate the app — check out the “Stocks”, “Mutual Funds”, “MF SIP”, “Portfolios” tabs. Use watchlists and filters to choose investments.

-

For mutual funds: select a scheme (direct plan for zero commission), choose SIP or lumpsum, enter amount. For stocks or F&O: use market / limit / stop‑loss orders as per need.

-

Monitor regularly: track your portfolio, profits/losses, allocations, and use ARQ or research tools if required.

Conclusion — Is Angel One Worth It?

Angel One offers a powerful mix of flexibility, affordability, and convenience, making it a strong option for many investors in India. Whether you are a beginner wanting to start small, or an experienced trader wanting multiple investment options under one roof — Angel One has a lot to offer.

That said — no app can guarantee profits. As with any investment platform, success depends on your knowledge, financial discipline, and willingness to learn. Use the tools smartly, invest responsibly, and treat those “zero‑brokerage” advantages as helpful — not magic.

If I were you and starting fresh, I would consider using Angel One for mutual funds and long‑term equity delivery, while being cautious about risky trades or excessive leverage.