If you’ve heard about “Upstox – Stocks & Demat Account” and are wondering what it really is, how it works, and whether it is worth using — you’re at the right place. In this blog post, we’ll explore Upstox’s features, pros & cons, safety, cost structure, and what you should keep in mind before opening an account. The language is simple, so even if you're new to investing, you’ll understand clearly.

🔎 What is Upstox?

-

Upstox is a digital brokerage platform in India, run by RKSV Securities (India) Private Ltd. (Invest Indian)

-

Through the Upstox app (available on Android and iOS), you can open a Demat + Trading account entirely online — no paperwork, no physical visits. (Upstox - Online Stock and Share Trading)

-

Once your account is ready, you can buy/sell stocks, derivatives (F&O), commodities, currencies, and also invest in mutual funds, IPOs, digital gold, etc., all from the same app. (One Credit Score)

-

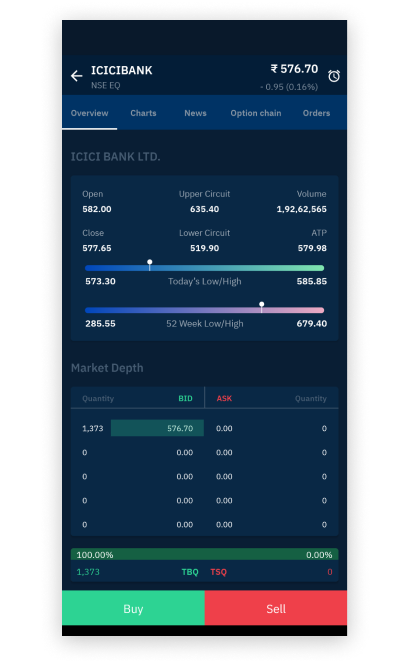

The app also provides real-time market data, advanced charting tools, order types, watchlists, and a user-friendly interface for both new and experienced users. (Upstox - Online Stock and Share Trading)

In short — Upstox aims to be an all-in-one solution for retail traders and investors to participate in the Indian stock market with minimal friction and relatively low cost.

✅ What Are the Main Benefits of Using Upstox?

- Easy & Paperless Account Opening

With Upstox, opening your demat + trading account is quick and done fully online. You typically need Aadhaar, PAN, bank details and a selfie — no paperwork. (Invest Indian)

Many users praise this simplicity and speed. (Let's think wise.com)

- Low Brokerage & Transparent Pricing

Compared to traditional brokers, Upstox offers a discount-brokerage model. Some of their charges (as of 2025) are as follows: (Hindigyan)

| Segment | Charge |

|---|---|

| Equity Delivery (long-term holding) | Very low / sometimes ₹0 (on certain offers) (Upstox - Online Stock and Share Trading) |

| Intraday / Futures & Options / Commodities / Currencies | Flat ₹20 per order (or 0.1% for intraday whichever lower) (Hindigyan) |

| Mutual Funds & IPOs | Often commission-free or very low (Upstox - Online Stock and Share Trading) |

This makes Upstox especially appealing if you trade frequently (intraday / F&O) or want to keep costs minimal on long-term investments.

- Powerful Tools & Features for Trading & Analysis

Upstox offers advanced charting and technical analysis tools — with 100+ indicators, multi-timeframe charts, drawing tools — via integrations like TradingView or ChartIQ. (One Credit Score)

Features like customizable watchlists, real-time market data, various order types (Bracket Order, Cover Order, Good‑Till‑Triggered, After Market Order, etc.) make it flexible for different trading styles — from beginners to experienced traders. (One Credit Score)

- Convenience & Mobile‑First Experience

You can trade or invest from your phone — whether you are at home or on the go. The interface is designed to be clean, intuitive, and fast. (Let's think wise.com)

Real‑time updates, instant order placement, and ability to handle equities, derivatives, IPOs, mutual funds all in one app make it a convenient choice. (FINTECH DEEPAK)

- Safety & Legitimacy

Upstox is registered with the regulator Securities and Exchange Board of India (SEBI) and is a member of major exchanges like National Stock Exchange of India (NSE), Bombay Stock Exchange (BSE), and Multi Commodity Exchange of India (MCX). (FINTECH DEEPAK)

They follow standard security practices: funds are stored in separate client accounts, user data is protected, and login features like biometrics, two‑factor authentication (2FA) are supported. (FINTECH DEEPAK)

These points give reasonable confidence that Upstox is not a scam — but a legitimate online brokerage platform.

⚠️ Drawbacks / Limitations to Know

While Upstox has many advantages, it's important to also understand its downsides — especially before trusting it with significant funds.

- Annual Maintenance Charges (AMC) & Demat Costs

Earlier, Upstox promised ₹0 AMC for some time. But many users have recently reported that Upstox now charges ₹150–₹300 per year as a demat account maintenance fee. (FINTECH DEEPAK)

This has caused dissatisfaction, especially among users who opened the account expecting lifetime free maintenance. As one Reddit user said (in a community thread):

“They clearly promised ₹0 AMC, but now they’ve shamelessly started charging ₹300 + GST.” (Reddit)

If you are a long‑term investor with few trades, this cost can eat into your returns.

- Customer Support & User Complaints

Some users report delays or poor responsiveness from Upstox customer support — especially when there are account closure requests or disputes about charges. (InstockBroker)

There are complaints from users who tried to close their account but were unable to because of unexpected negative balances caused by AMC charges. (Reddit)

- No Advisory / Research Services

Unlike full‑service brokers, Upstox does not provide in-depth research, stock recommendations, advisory services, or a “3‑in‑1 account” (bank + demat + trading). It’s purely a trading/investment interface. (Trade Brains)

So, if you are a beginner who prefers expert research or personal guidance, Upstox might feel limited.

- Occasional Technical Issues & Lack of Offline Support

Because Upstox is a fully online (digital) broker, there is no physical branch for in‑person support. (Hindigyan)

Some users have reported app lags, login issues or glitches, especially during peak market hours. (Let's think wise.com)

Also, if you are trading complex instruments or doing margin/F&O, frequent policy changes or margin requirement changes may confuse beginners. (Hindigyan)

📌 Who Should Consider Using Upstox — and Who Should Think Twice

👍 Good For

-

Beginners and small investors who want a low‑cost, easy-to-use platform.

-

Intraday traders, derivatives & options traders, or frequent traders looking for low flat fees.

-

Investors who value a digital, mobile-first interface and want to control their investments without needing advisory.

-

People comfortable managing their portfolio themselves, without needing research reports or hand-holding.

⚠️ Maybe Not Ideal For

-

Long-term investors with low trading frequency — AMC charges may reduce net returns.

-

Investors needing advice, research, or a full-service broker experience.

-

People preferring to trade via phone support or offline brokers.

-

Users sensitive to occasional glitches, customer-support delays, or who mistrust AMC/hidden charges.

🧾 My Verdict & What to Watch Out For

Upstox is, by and large, a strong, legitimate and convenient platform for many Indian investors — especially those comfortable doing their own research and wanting a low-cost, easy-entry path into stocks/futures/mutual funds. Its digital-first onboarding, multiple asset classes, good charting tools, and flexible fee structure offer strong value for money.

However — don’t ignore the annual maintenance fees (AMC), and make sure you understand when and how Upstox charges you. If you open an account, but trade rarely, AMC may eat into your gains. Also, because Upstox doesn’t offer advisory or deep research, only use it if you’re confident in your own investing/trading decisions.

In short: ✅ Great for active traders or self-directed investors. ⚠️ May be less optimal for passive, buy‑and‑hold investors who dislike recurring costs.